When you open an online trading account in a U.S. brokerage account like Charles Schwab or TD Ameritrade, and you’re not an American citizen, you don’t have a green card, and you don’t live in the U.S., you’re generally classified as a non-resident alien by the Internal Revenue Service (IRS) of the U.S. Even as a non-resident alien, some or all of your income from your trading account may still be subject to taxes by the U.S.

Continue reading Investing in the US from the Philippines as non-resident alien: IRS tax issuesMonthly Archives: November 2019

Charles Schwab vs Capital One 360 ATM Exchange Rate

As a follow up to my previous post comparing effective ATM exchange rates for withdrawing Philippine pesos from US dollar accounts from Charles Schwab and Transferwise, I now compare Charles Schwab and Capital One 360.

Continue reading Charles Schwab vs Capital One 360 ATM Exchange RateThe true costs of FMETF

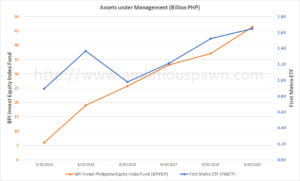

First Metro ETF (FMETF) is the only ETF available in the Philippine Stock Market. I’ve written previously about how FMETF compares to ETFs in Vietnam and Thailand. I’ve also noted how FMETF’s assets under management is dwarfed by BPIPEIF, a similar index tracker in UITF form.

Whenever one mentions FMETF, it is invariable described as a low-cost index tracker. Its management fee is supposed to be 0.5%. That it in itself is low by Philippine standards when comparing to mutual fund management and UITF trust fees. For a supposed passive fund, it is still high when comparing to well-established ETFs in the US like SPY and VTI.

FMETF vs BPI Invest Philippine Equity Index Fund Assets

I previously compared FMETF with ETFs from neighboring Asian countries and found that FMETF’s total assets under management as percentage of the market capitalization of the index it tracks seems low compared to ETFs from Vietnam and Thailand. I noted that one reason may be due to the availability of mutual funds and unit investment trust funds (UITFs) that also track the same PSE Composite Index (PSEi).

Continue reading FMETF vs BPI Invest Philippine Equity Index Fund Assets

ETFs in Philippines versus Thailand and Vietnam

FMETF is currently the only exchange-traded fund (ETF) available in the Philippine Stock Exchange. FMETF was launched in 2013 and aims to track the performance of the PSE Composite Index (PSEI), which tracks 30 companies in the Philippine Stock Exchange.

As of November 4, 2019, FMETF’s total assets is PHP 1,680,365,665.87 or about $33.3 million. In comparison, the total PSEi market capitalization is PHP 10,073,517,502,927.30 or about $199.4 billion. So, FMETF’s market cap is 0.0167% of that of the PSEi, six years after it was first introduced. And again in that span of time, no other ETF was introduced in the market.

I was curious how ETFs in a neighboring countries fare. The Stock Exchange of Thailand (SET) has a quite a few ETFs available. The TDEX ETF introduced in 2007 tracks the SET50 index, and the ETF has total assets of $3.1 billion compared to SET50 capitalization of $388 billion. TDEX’s market cap is about 0.8% of that of the SET50 index. Keep in mind that there several ETFs in the Thailand market, some covering the larger SET100 and quite a few covering specific sectors. Needless to say, the Thai stock market is larger than the Philippine market.

Continue reading ETFs in Philippines versus Thailand and Vietnam

TransferWise vs Charles Schwab Exchange Rate at a Philippine ATM

TransferWise is an online money transfer fintech company. What’s great about them is they try to be transparent with their fees for transferring money internationally. They promise the best exchange rate possible, but they do charge fees for ACH bank transfers that are otherwise free for regular banks. In most cases they are cheaper than using wire transfer through your bank or services like Western Union or MoneyGram. They also offer a product called the Borderless account which allows you to have multiple currencies in your account. It also comes with an ATM/debit card you can use internationally. This service seems to be popular with so-called digital nomads. I guess this is also a good account for getting cash when you are travelling internationally.

Continue reading TransferWise vs Charles Schwab Exchange Rate at a Philippine ATMTax-loss harvesting in the Philippine stock market?

In the US, losses incurred from selling stocks from losing investments can be used to lower capital gains from winning trades.Short-term capital gains are taxed as though they are ordinary income which is taxed based on a progressive tax table. Near the end of the year, if you already have realized some gains (that you’ll have to pay taxes on) and are still holding on to some losing positions, you may decide to cut your losses and sell your losing stock positions. This will allow you to harvest losses to offset some of your gains, thereby reducing taxes that you’ll have to pay. If you don’t have any gains to offset, you can also reduce your ordinary income (wages, etc.) by up to $3,000 of your losses. In a way, this may encourage you to stop holding to that losing stock and cut your losses, and also reduce your tax bill. On the other hand, the stock might recover and you’ll miss out on it. You’re not allowed to buy the stock again within 30 days of selling it, and still be able to harvest the loss, because of wash sale rules.

Continue reading Tax-loss harvesting in the Philippine stock market?