I haven’t used my Schwab Visa debit card to take out cash from an HSBC Philippines ATM since December 2019 (when the USD-PHP exchange rate was around PHP 50.82 to USD 1) until last Friday. Since end-2019 we’ve had a global pandemic, the USD-PHP exchange rate reached a low of around 47.53 and, in recent weeks, the rate reached a record high of around 56.54, and my usual go-to HSBC Ortigas Center branch moved from its ADB Avenue location to the nearby Shangri-La Plaza mall.

Anyway, last Friday, I decided to take out some cash to take advantage of the high exchange rate and also to see whether HSBC still does not charge any fee for using a Schwab ATM/debit card and whether the applied exchange rate is still competitive.

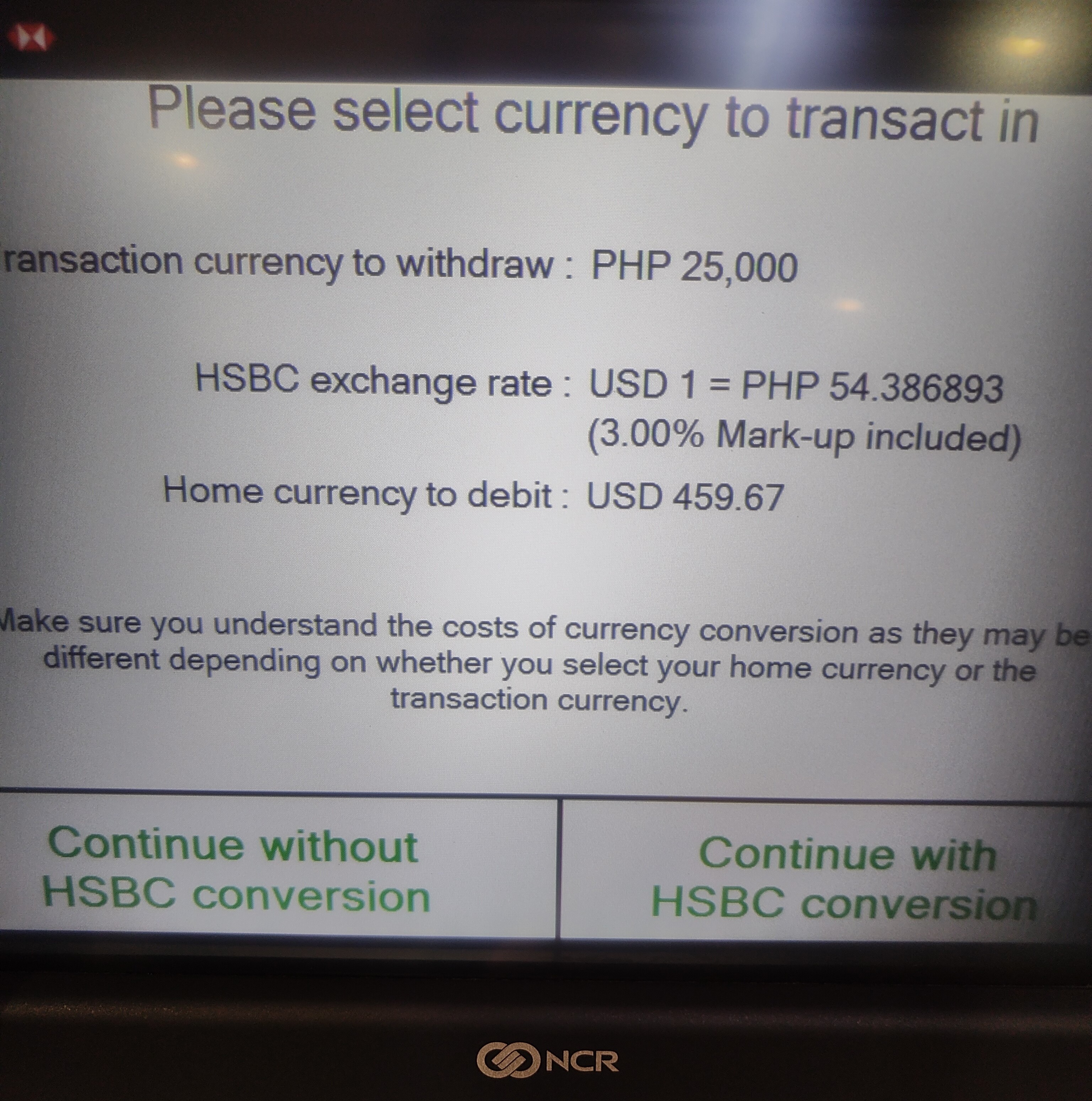

On one of the screens, the ATM warns that some fee may be charged by my card issuer (Schwab), but the HSBC ATM itself still did not add any explicit fee to my PHP 25,000 withdrawal. One screen that I don’t remember seeing before is an offer by the HSBC ATM to apply the HSBC exchange rate with enough warning that a 3% mark-up is included in the rate.

Every savvy traveler should know that these conversion rate offers should generally be avoided, especially if one is using a card that does not have any forex surcharges/fees. Depending on how one calculates the mark-up (x*1.03 or x/0.97), the implied rate without markup would have ranged between 56.018 and 56.069. The entire range is lower than the rate quoted by Google at the time which was 56.33:

After a couple of days, the withdrawal posted and $443.74 was debited from my account for an equivalent USD-PHP exchange rate of 56.339, which is slightly better than the Google rate, and obviously better than HSBC’s rate with or without mark-up.

Key Points

- Using a Schwab ATM/debit card at an HSBC Philippines ATM is still fee-free.

- Don’t use HSBC’s own conversion rate to take advantage of Schwab’s competitive rate.