I’ve written a few posts on how the Philippines taxes income from capital gains and dividends from foreign stocks:

- How are foreign capital gains taxed in the Philippines?

- Are gains from US equity feeder funds taxable by the BIR?

It was confusing at first but I have since come to the conclusion that since there is no law or BIR ruling that specifically provides for fixed tax rates or exempts foreign capital gains and dividends, they fall into the catch-all category of “non-business/non-profession” income that will be taxed at ordinary graduated income rates. Still, I have few more questions.

Where do I enter foreign capital gains and dividends income on the income tax return form?

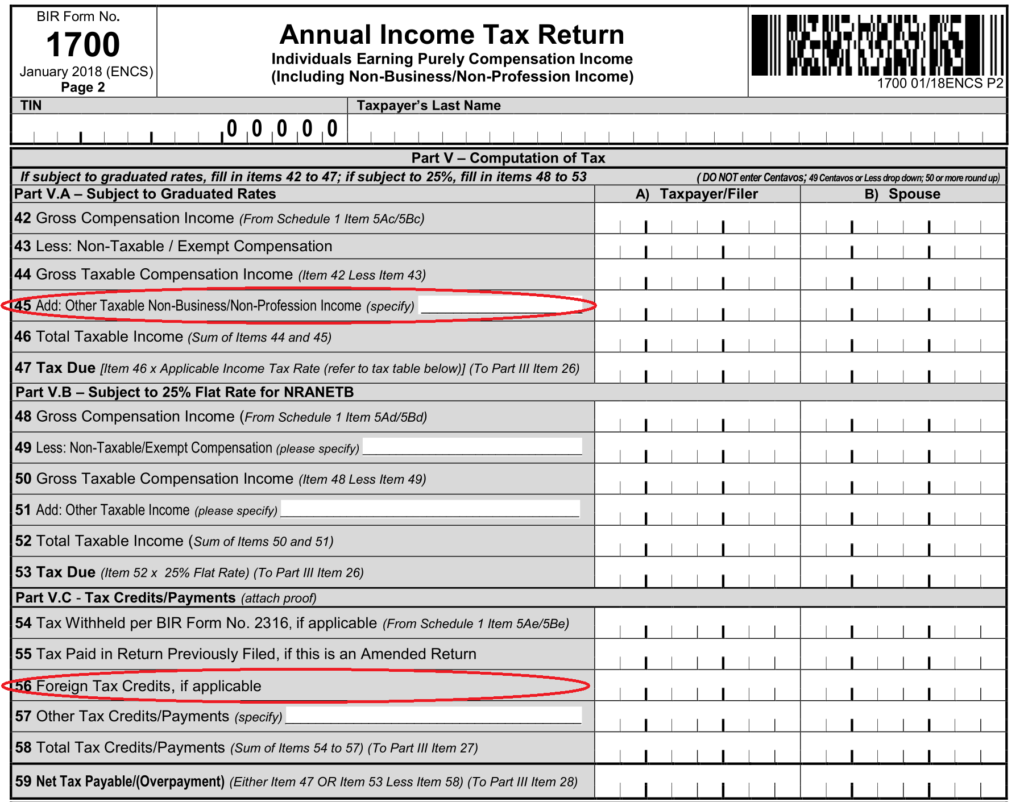

If I’m not mistaken, the only place you can enter this type of income is on Line 45 of Form 1700: Other Taxable Non-Business/Non-Profession Income. This appears to be the catch-all field for all other income that the BIR has not provided a final tax rate or exemption. What if you have different types of this income (e.g. foreign capital gains, foreign dividends, gambling income, foreign gifts)? Well, the BIR apparently did not imagine such possibility when they designed their forms. Strangely, there is no supporting documentation required for the amount you enter on Line 45.

Can foreign capital losses be used to offset foreign capital gains?

It seems obvious to think that if the government wants a share of your gains, it should also have a share in your losses. That’s how it works in the US, at least. Any capital loss can be used to reduce your net capital gains. If your losses exceed your gains, then you can deduct up to $3,000 of your net losses each year from the rest of your ordinary income. If your net losses exceed $3,000, then you can use the excess deduction in subsequent years.

Philippine tax authorities do not have any published rules on whether you can deduct losses from your gains, so legally this appears to be a gray area. Since no supporting documentation is required for the Line 45 amount, it’s probably safe to enter net gains.

Can net foreign capital loss be deducted from ordinary income?

Again, the BIR has no published rule that allows this kind of deduction. The likely answer is no.

Can foreign tax credits be used to offset Philippine tax liabilities?

Line 56 in Form 1700 allows one to enter foreign tax credits. I haven’t found any published BIR rule on how to properly claim foreign tax credits and if there are any limits to such claims. For example, the U.S. withholds 25% tax on dividends and 15% tax on interest. If your only income comes from dividends and falls within the <PHP 250,000 0% tax bracket, then I guess you cannot apply the foreign tax credit since no Philippine tax is due on the dividend income. But what if your total income now falls under the 20% bracket, can you claim the entire 25% foreign tax credit, or only up to 20%? Will it be different if you fall under higher tax brackets? I was not able to find the answer to these questions on the BIR website.

If any Philippine tax expert comes across this post, I’d like to hear your comments and corrections.

Hi, did you find out if you really have to pay capital gain tax on foreign securities as a resident or non resident alien engaged or not in business and trade ?

when you look at the bir website i understand that only domestic stocks are liable to tax.

Thanks

Since I am not a tax lawyer or accountant, I cannot give you a definitive answer. But I have a feeling that if you ask the BIR directly, they will say that capital gains on foreign securities are subject to Philippine tax. The BIR says that “A resident citizen is taxable on all income derived from worldwide sources”. The tax rate on this income is based on the graduated tax table unless the BIR or the law says otherwise. Specific types of income like dividends or interest have explicitly indicated final withholding tax rates. The BIR only has a capital gains tax on sales of domestic stocks not listed in the local stock market. It does not say anything special about foreign securities, so, in this case, graduated tax rates will probably apply.

Hi, the tax base is the most important. In the philippines it is territorial. Foreign gains won’t be taxed if it’s not your business in the philippines. see badges of trade.

it’s the same type of tax as in malaysia, thailand…

thanks to your site, i realized dividend tax was 25% and not 15% as i previously thought.

so thanks

The Philippine tax bureau explicitly states that with few exceptions, “a resident citizen is taxable on all income derived from worldwide sources” in contrast to neighboring countries like Malaysia and Singapore where foreign-source income is not taxable.

hi, yes a resident PH citizen will be taxed on worldwide income. not a foreigner. And an active trader that trade very often or trade complex product like options… etc will be considered a professional trader and thus also likely taxed in the Philippines. but not a passive investor.

at least that’s how i understand it…

If the Philippines have both acknowledged the concept of capital gains and specified where it applies, how could they then classify such gains as income?

You could equally say that gains on sale of your main US or UK residence should attract income tax because they are not taxed under capital gains rules.

Wondering if you filed that last year without problems? Did the BIR just take that without questions?

Planning to file myself this year, and I’m stuck with tax anxiety. As you said, no clear answers.

Hi thanks for your posts. Very enlightening. Any updates on taxes for foreign sources? Did you pay your taxes in the US or is it automatically deducted by your broker? Also did you pay BIR?

What if you did not sell any of your stocks? Are you still required to pay capital gains for this? Thanks! Stay safe!