I previously compared FMETF with ETFs from neighboring Asian countries and found that FMETF’s total assets under management as percentage of the market capitalization of the index it tracks seems low compared to ETFs from Vietnam and Thailand. I noted that one reason may be due to the availability of mutual funds and unit investment trust funds (UITFs) that also track the same PSE Composite Index (PSEi).

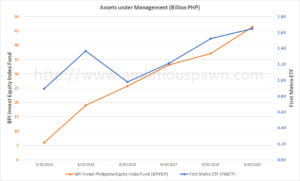

One such UITF is the BPI Invest Philippine Equity Index Fund (BPIPEIF). As of this posting, its total assets amount to almost PHP 49 billion. In comparison, FMETF has total assets amounting to PHP 1.7 billion. I then dug up the total assets of each fund over the past five years as shown in the chart. BPIPEIF has grown more than 9 times while FMETF barely doubled. Today, BPIPEIF’s assets is more than 28 times that of FMETF.

I find this a little puzzling because FMETF’s fee is just 0.50% compared to BPIPEIF’s 1% (1.5% before 2018). Conventional wisdom tells me investors would prefer the lower fee ETF. Why are billions pouring into BPI’s UITF but not to FMETF? Could BPI’s returns be higher or the same despite its higher fees? I haven’t really looked into this in detail. Is it because it’s simply easier to invest in the UITF if you’re a BPI client because you don’t need to open a separate brokerage account? After 6 years in the market, are many investors still not aware of FMETF and its lower fees? What am I missing?

Leave a Reply