FMETF is the only ETF available in the Philippines. It tracks the 30-component PSEi. In a previous post, I noted that FMETF is a de facto accumulating ETF, since it has never distributed any cash dividends, in spite of its declared intention to do so.

Continue reading Discrepancies in FMETF split-adjusted price historyCategory Archives: Stocks

Is FMETF an accumulating ETF or a distributing ETF?

The Philippines has only one available ETF in the market: the pioneering First Metro ETF (FMETF) which aims to the track the PSE Composite Index (PSEi).

When an ETF receives dividends from corporations whose shares it owns, it can either reinvest those dividends within the fund (accumulating ETF), or distribute the dividends to ETF shareholders (distributing ETF). So under which category does FMETF fall?

Continue reading Is FMETF an accumulating ETF or a distributing ETF?Avoiding home-country bias in the Philippines

Home-country bias is the tendency of an investor to over-invest in his/her country’s domestic equity market in a scale that significantly exceeds the proportion of the size of the domestic market relative to the rest of the world.

Considering that even Americans, whose own stock market is 40% to 50% of the world market, can be guilty of home-country bias, it is not a surprise that investors from much smaller markets like the Philippines also exhibit this behavior. This is shown in the chart below, which visualizes data collected by Sercu and Vanpée from CPIS (December 2005) and World Federation of Exchanges, in their paper, Home bias in international equity portfolios: a review. When that paper was published, Filipinos’ equity portfolios were 99.5% domestic while the domestic market was just 0.1% of the world market cap.

Continue reading Avoiding home-country bias in the PhilippinesAre gains from US equity feeder funds taxable by the BIR?

I previously wrote about the lack of information on how the Philippine Bureau of Internal Revenue taxes foreign capital gains, dividends, and interest income. We know that the U.S. imposes a final withholding tax of 25% and 15% on dividend and interest income, respectively for Philippine residents based on the U.S.-Philippines tax treaty. On the other hand, capital gains received by non-resident aliens are not taxed by the U.S.

The BIR has no published rule that sets an explicit final tax rate on foreign capital gains income. Local stock market sales are taxed based on the gross sales amount. Capital gains on shares on unlisted domestic corporations are taxed at 15%. The going assumption then is that any income not subject to an explicit final tax rate is subject to the graduated personal income tax rates.

Continue reading Are gains from US equity feeder funds taxable by the BIR?Is it worth investing in a US Equity Index feeder fund from the Philippines?

If you’re a Filipino investor and you want your investment portfolio to diversity into U.S. index funds, you have at least two options. One option is to open a trading account with a company like Charles Schwab. This will give direct access to thousands of U.S. stocks and ETFs.

An easier option is to invest in a unit investment trust fund (UITF) that acts as a feeder for a U.S. index fund. One such feeder fund is the BPI Invest U.S. Equity Index Feeder Fund (BPIUSFF). This fund invests directly in the largest ETF in the world, the SPDR S&P 500 Trust ETF (SPY). This ETF has total assets of almost $280 billion as of November 2019. It simply aims to track S&5 500 index of U.S. large cap companies. One reason why people like to invest in index funds is the low expense ratio. SPY’s gross expense ratio is only .0945%.

Continue reading Is it worth investing in a US Equity Index feeder fund from the Philippines?On online trading commissions in the Philippines

When I first looked into trying my hand in the Philippine stock market and opening an online brokerage account, I was pleasantly surprised by the number of online platforms available to retail investors. There are 31 online brokers on this list on the Philippine Stock Exchange website. Quite a few are backed by major Philippine banks like BDO, BPI, and Metrobank, while many more are independent brokerage houses. At least nine of them run on the PSETradex platform provided by the Philippine Stock Exchange itself.

Before this, my only experience with trading stocks was in the U.S. with brokers like Ally, Robinhood, and now Charles Schwab. Recent competition among U.S. online brokers have driven down the cost of trading commissions to the bare minimum: $0. Charles Schwab charged $29.95 per trade in 1998. Before dropping the rate to $0 in October 2019, it was charging $4.95 per trade.

Continue reading On online trading commissions in the PhilippinesHow are foreign capital gains taxed in the Philippines?

I previously discussed how the US taxes dividends and interest income of non-resident aliens investing in the US stock market. In summary, 15% tax is withheld from interest income, 25% tax is withheld from dividend income, while no taxes are withheld from capital gains.

(NOTE: Check out the post – More questions on Philippine taxation of foreign capital gains and dividends – for my most recent thoughts on this topic.)

But how does the Bureau of Internal Revenue (BIR) in the Philippines tax these types of income? The short answer is: It’s not clear. The long answer is as follows:

Continue reading How are foreign capital gains taxed in the Philippines?Investing in the US from the Philippines as non-resident alien: IRS tax issues

When you open an online trading account in a U.S. brokerage account like Charles Schwab or TD Ameritrade, and you’re not an American citizen, you don’t have a green card, and you don’t live in the U.S., you’re generally classified as a non-resident alien by the Internal Revenue Service (IRS) of the U.S. Even as a non-resident alien, some or all of your income from your trading account may still be subject to taxes by the U.S.

Continue reading Investing in the US from the Philippines as non-resident alien: IRS tax issuesThe true costs of FMETF

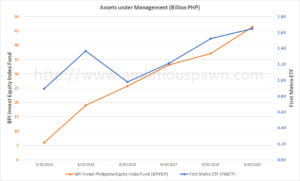

First Metro ETF (FMETF) is the only ETF available in the Philippine Stock Market. I’ve written previously about how FMETF compares to ETFs in Vietnam and Thailand. I’ve also noted how FMETF’s assets under management is dwarfed by BPIPEIF, a similar index tracker in UITF form.

Whenever one mentions FMETF, it is invariable described as a low-cost index tracker. Its management fee is supposed to be 0.5%. That it in itself is low by Philippine standards when comparing to mutual fund management and UITF trust fees. For a supposed passive fund, it is still high when comparing to well-established ETFs in the US like SPY and VTI.

FMETF vs BPI Invest Philippine Equity Index Fund Assets

I previously compared FMETF with ETFs from neighboring Asian countries and found that FMETF’s total assets under management as percentage of the market capitalization of the index it tracks seems low compared to ETFs from Vietnam and Thailand. I noted that one reason may be due to the availability of mutual funds and unit investment trust funds (UITFs) that also track the same PSE Composite Index (PSEi).

Continue reading FMETF vs BPI Invest Philippine Equity Index Fund Assets